missoula property tax increase

Missoula County collects on average 093 of a propertys. Missoula Current Published.

Missoula Is Up To Its Eyeballs In Debt

12 hours agoYour electricity bill is going up 126 percent this month or 1119 if youre an average residential customer with NorthWestern Energy.

. The local marijuana tax approved by Missoula County voters netted the city just 350000 in this budget cycle. Missoula County Administration Building. Our new analysis takes three missoula homes estimated to be close to the citys median home.

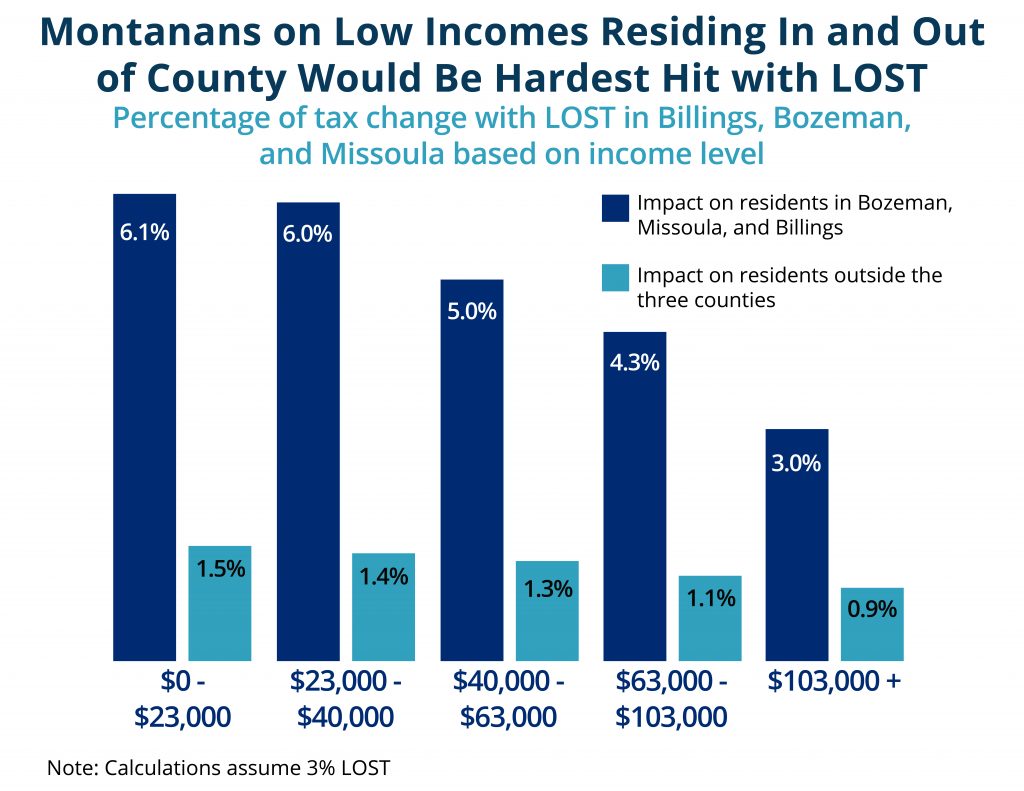

Meanwhile the state is sitting on a budget surplus of more than. Taxation of real property must. Missoulas problems are even worse when compared to property tax increases nationally which increased at an average rate of 32 between 2016 and 2020.

The tax jump comes as a result of inflation and the citys decision not to raise property taxes over the past. Missoula City-County Health Department. The countys budget if.

Missoula Property Tax Increase. Missoula taxes set to increase almost 12 under new budget. 1 be equal and uniform 2 be based on current market worth 3 have.

Thats 13428 a year but its less. The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700. Missoulas problems are even worse when.

The Department of Revenue a division of the State of Montanas government determines the market value of residential and commercial property once every two years. The Missoula City Council this week approved its new budget which includes a tax increase of 44 for every 100000 of a homes assessed value. County proposes 25 million budget expenditure increase 10 tax hike The budget represents a jump from the.

The budget will lead to an 1159 tax increase for Missoula property owners. Note too that under state law you can elicit a vote on proposed tax increases above established ceilings. A citys real estate tax rules must comply with Montana statutory rules and regulations.

Missoula County is proposing an 8 percent increase in property taxes to balance its new annual budget and its also calling on. Missoula County Community and Planning Services. Average Missoula County home 15 assessed value increase to 350000 for fiscal year 2022 140 increase in county portion of property taxes.

County Services City of Missoula. In setting its tax rate the city is mandated to observe the state Constitution. Missoula County Animal Control.

The value of your.

Tax Increases Likely City Of Missoula Fighting Inflation State S Broken Tax System

Property Tax Initiative Garners Few Signatures Daily Montanan

Montana Property Tax Calculator Smartasset

How Do Property Taxes In Missoula Mt Work

Lost Ground Local Option Sales Tax Leaves Many Communities Behind Montana Budget Policy Center

12 Percent Tax Increase Part Of 2022 Missoula City Budget

Missoula County Launches New Property Tax Allowance Aimed At Solar Panels

Want To Estimate Your Property Tax Bill The Idaho State Tax Commission Has A Tool For That Across Idaho Id Patch

Are Missoula S Property Taxes High

Tax Breaks For Montana Property Owners Inspect Montana

Missoula Mt 1904 Letterhead Insurance Real Estate G Brooks Montana Mont Ebay

Missoula Taxes Set To Increase Almost 12 Under New Budget

Job Opportunities Missoula County Career Pages

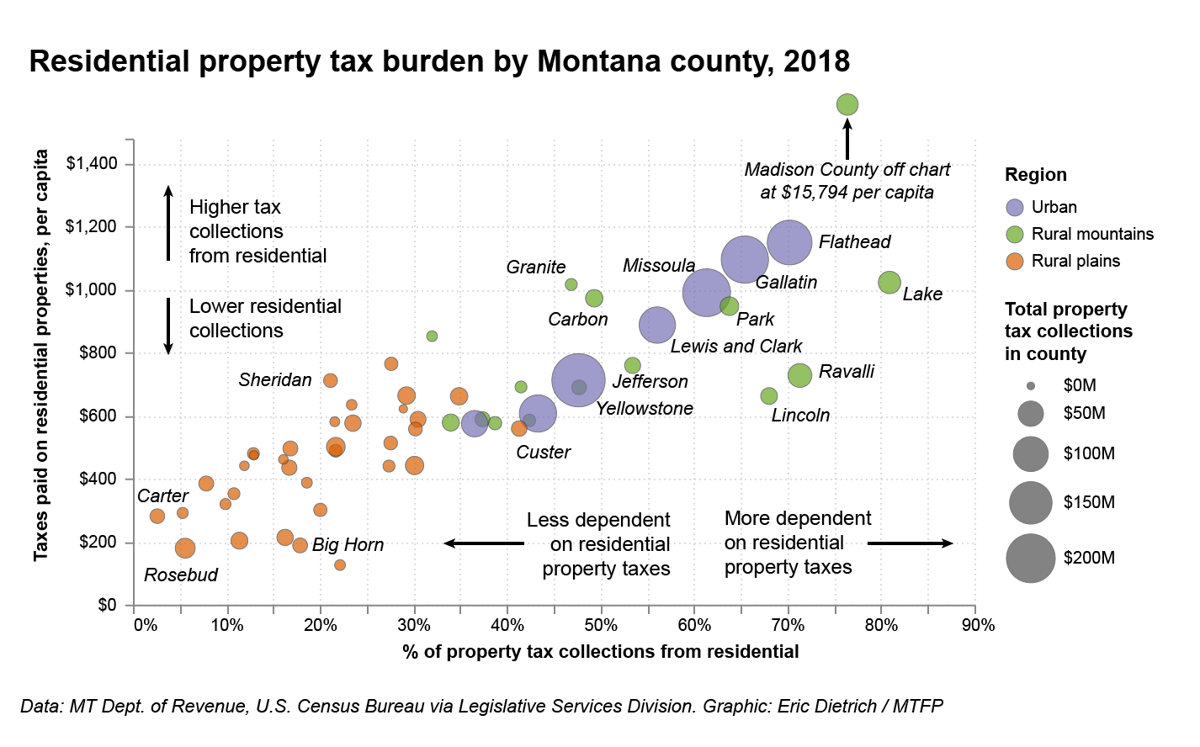

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads State Regional Helenair Com

Missoula Real Estate Market Trends And Forecasts 2020

Missoula Voters Asked To Increase Funding For Elderly Services

Montana Property Taxes Rise To Cover Cuts In School Grants Montana Public Radio