income tax calculator philippines

8 withholding tax for self-employed and professionals. Tax Refund Php 17585.

Calculating Income Tax Payable Youtube

This will calculate the semi-monthly withholding tax as well as the take home pay.

. You must always be sure to go with the best efficient updated and legitimate online tax calculator program. The Monthly Wage Calculator is updated with the latest income tax rates in Philippines for 2022 and is a great calculator for working out your income tax and salary after tax based on a. 6 rows The compensation income tax rate in The Philippines is progressive and ranges from 0 to 35.

Income tax due 8 x Gross sales or receipts Non-operating income Php. Net taxable compensation and business income of resident and non-resident citizens resident. Tax Calculator Philippines Description of Calculator.

Salary and allowances of husband arising from employment. Pangasinan town welcomes 40-M investment - Philippine News Agency. Salary of PHP 652000 living allowances of PHP 100000 and housing benefits 100 of PHP 300000.

Taxable Income per Year. Total Annual Tax Due Php 25000. CREATE Law changes can better.

The general rate of VAT in The Philippines is 12 though some items are rated at 0. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes. Magnitude of Tax Subsidy Grant.

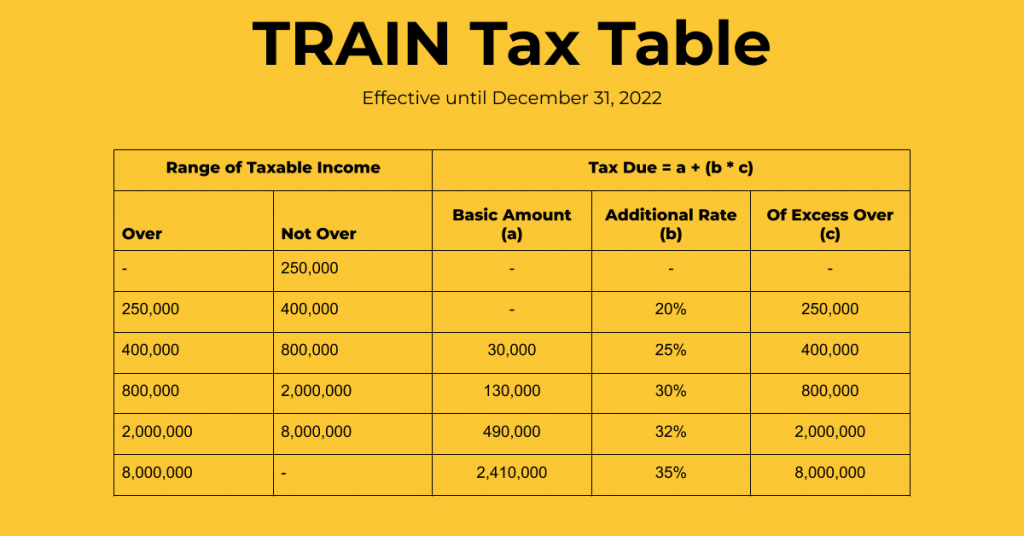

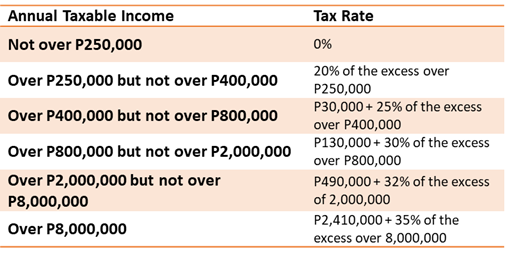

Accordingly the withholding tax. The new income tax rates from year 2023 onwards as per the TRAIN law are as follows. Procedures for Availment of Tax Subsidy of GOCCs.

Income Tax Rate Year 2023 onwards P250000 and below. 2202500 35 of the excess over 5000000. Computation of Tax Refund.

For self-employed individuals earning income solely from business andor profession. Sweldong Pinoy is a salary calculator for Filipinos in computing net pay withholding taxes and contributions to SSSGSIS PhilHealth and PAG-IBIG. Highlights of the FIRB Accomplishment Report CY 2014.

The contributions for PhilHealth is. There are now different online tax calculators in the Philippines. Based on the information above the employer over-withheld an amount equal to Php.

Taxable income band PHP. Inputs are the basic salary half of monthly. The 8 withholding tax rate replaces the.

Income Tax Calculator Philippines Who are required to file income tax returns Income tax law provided in Tax Code of 19997 governs income tax procedures in Philippines resident citizens. VAT is a value added sales tax used in The Philippines. SP retains Philippine GDP growth outlook for 2022 - Philippine Star.

Income Tax Calculation Formula With If Statement In Excel

2022 Bir Train Withholding Tax Calculator Tax Tables

Provision For Income Tax Definition Formula Calculation Examples

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Excel Formula Income Tax Bracket Calculation Exceljet

How To File Your Annual Itr 1701 1701a 1700 Updated For 2021

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

How To Calculate Income Tax In Excel

How To Calculate Foreigner S Income Tax In China China Admissions

Tax Calculator Compute Your New Income Tax

Tax Calculator Compute Your New Income Tax

How To Calculate Income Tax In Excel

Philippines New Tax Law Calculation Of Withholding Tax Steemit

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

How To Create An Income Tax Calculator In Excel Youtube

How To Compute Quarterly Income Tax Return Philippines 1701q Business Tips Philippines